Low-Carbon Pathway for the Chemical and Fertilizer Sector

With support of the European Bank for Reconstruction and Development (EBRD) UKS together with the international consultant ERM developed a roadmap for low-carbon pathway of Navoiazot JSC, the largest producer of nitrogen fertilizers in Uzbekistan.

Navoiyazot Climate Disclosure following Recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD)

Climate change represents a strategic risk, but also an opportunity with potential financial implications for JSC Navoiyazot and all our stakeholders. That is why we are committed to analyse and disclose such climate-related business implications following the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

TCFD is a framework created by The Financial Stability Board (FSB) and developed by a Task Force of industry experts from various organizations, which provides guidance for companies on to the assessment and disclosure of climate-related risks and opportunities, and their integration into wider risk management frameworks within the organization.

This is the first TCFD-aligned climate disclosure of JSC Navoiyazot. It is structured around the following pillars of the TCFD framework:

- Governance

- Strategy

- Risk Management

- Metrics and Targets

1.Governance:

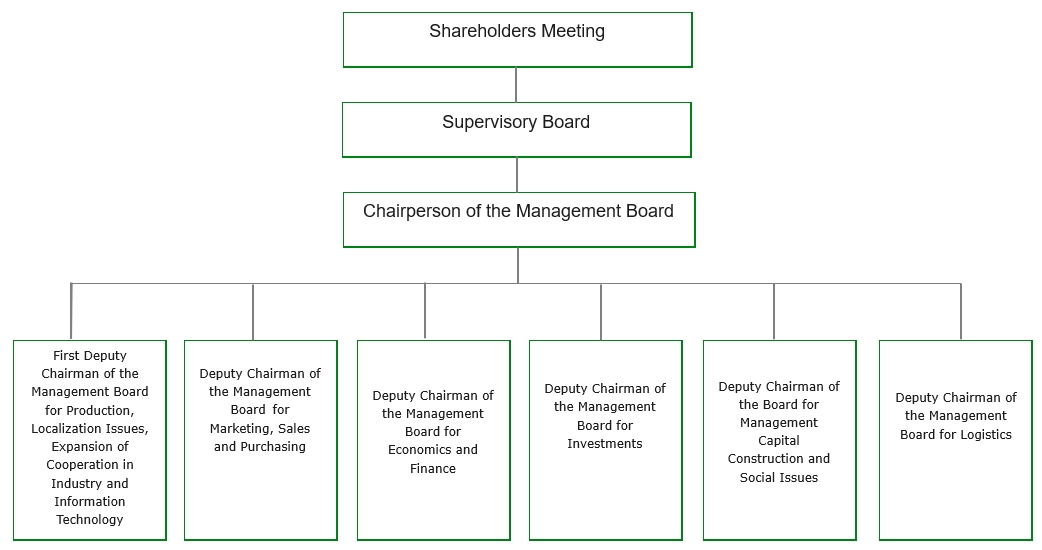

The governing structure of JSC Navoiyazot is a three-tiered structure with the Shareholders Meeting as the supreme governing body of the company. Furthermore, the Supervisory Board reports to the Shareholders Meeting.

The members of the Supervisory Board include:

- The First Deputy Minister of Mining Industry and Geology of the Republic of Uzbekistan (Chairperson);

- The Minister of Energy of the Republic of Uzbekistan;

- Hokim (a governor of administrative region) of Bekobad district of Tashkent province;

- Executive at Uzkimyosanoat (UKS) - our holding company;

- The Deputy Director of the Department of the Ministry of Economy and Finance;

- The Head of the Department of the Ministry of Investment, Industry and Trade; and

- The Director General of the Agency for Strategic Reforms under the President of the Republic of Uzbekistan.

The Chairperson of the Management Board leads the Management Board, which consists of:

- First Deputy Chairman of the Management Board for Production, Localization Issues, Expansion of Cooperation in Industry and Information Technology;

- Deputy Chairman of the Management Board for Marketing, Sales and Purchasing;

- Deputy Chairman of the Management Board for Economics and Finance;

- Deputy Chairman of the Management Board for Investments;

- Deputy Chairman of the Board for Management Capital Construction and Social Issues;

- Deputy Chairman of the Management Board for Logistics.

On our website we provide information on background and relevant expertise of the management board members: https://www.navoiyazot.uz/en/executive.

Organisational structure of JSC Navoiyazot

Management leads our mission and defines strategic direction where the preservation of favorable environment and rational use of natural resources is fundamental.

We have established communication, monitoring and reporting procedures for environmental topics (e.g. air and water). The heads of relevant departments, such as the departments of Ecology, Health and Safety and the Chief Energy Engineer report two times per year to the Deputies of the Chairperson of the Management Board on achieving maximum permissible KPIs (Key Performance Indicators). The Chairperson of the Management Board reports to the Supervisory Board.

We have established an ESG Working Group at JSC Navoiyazot, which meets every two weeks, and is responsible for Environmental, Social and Governance (ESG) topics, including climate change as one of priority ESG issues identified for our company. It consists of the following members:

- The Deputy Head of Department of Technologies;

- The Deputy chief Engineer for Energy;

- The Head of Department for Environmental Protection and Rational Use of Natural Resources;

- The Head of the Industrial and Radiation Safety Service;

- The Head of Ammonia and Urea Production department;

- The Head of Ammonia-3 Production department;

- The Head of Organic Synthesis and Nitro Fiber Production; and

- The Head of Production of Unconcentrated Nitric Acid Shop #916, the Head of Steam Gas Supply Shop # 49.

In 2023, several capacity building training sessions on greenhouse gas (GHG) accounting and climate-related risks and opportunities have been conducted at JSC Navoiyazot by an external expert company. Training sessions targeted both top management and mid-level management.

We have started our journey towards identifying and considering climate-related issues in the company’s strategy and processes. The involvement of top management has been recognized. The company plans to include climate related topics and TCFD recommendations in existing governing documents of the company, including the company’s Articles of Association, risk register and others.

2.Strategy:

In 2023, we engaged an external consultancy ERM (Environmental Resources Management) focused on sustainability services for organizations worldwide to perform an assessment of climate-related risks and opportunities at JSC Navoiyazot. During the assessment impact of physical climate change on operations of the company was analyzed, as well as the risks and opportunities related that company faces in the transition towards a low carbon economy. The assessment included a scenario analysis to evaluate how the identified risks and opportunities can evolve over time under low carbon and high carbon scenarios.

Overall, transition-related risks and opportunities are balanced given JSC Navoiyazot’s business footprint (mostly local and regional customers), and currently limited regulatory and market pressure for a transition to a low carbon economy in Uzbekistan and our key markets (Central Asia and Asia regions). Risks may increase if Uzbekistan updates its carbon related policies, or if we decide to enter new markets with already existing carbon pricing regulations.

Regarding physical risks, it was identified that our company site has a 'Low' average exposure to climate physical hazards. However, our operations may be more at risk of experiencing the impact of specific hazards such as water stress and drought, wildfires and extreme cold. Due to the increase in the severity of these extreme events, negative impacts on the business could be exacerbated (see table 1).

Transition risk & opportunities

As recommended by the TCFD, scenarios should be used to evaluate the company in a base case and a low carbon scenario. Transition scenario indicator data comes primarily from the Network for Greening the Financial System (NGFS) Climate Scenarios 2022, supplemented by the International Energy Agency’s (IEA) World Energy Outlook 2023.

Accordingly, we have utilised two forward-looking climate scenarios:

- Current Policies – This scenario is most aligned with current policy and economy wide progress, with an expected temperature outcome of + ~3°C by the end of the 21st century. As such, this is to an extent already integrated into company risk management.

- NZ2050 – This is an ambitious scenario that limits global warming to 1.5 °C through stringent climate policies and innovation, reaching net zero CO₂ emissions around 2050. This scenario assumes that ambitious climate policies are introduced immediately.

Three future time horizons have been considered in the assessment together with the baseline (current climate) conditions. These were considered most applicable to JSC Navoiyazot’s business: 2030 (considered as short-term), 2040 (considered as medium-term), and 2050 (considered as long-term).

Physical risks

The 2021 Intergovernmental Panel on Climate Change (IPCC) 6th Assessment Report (AR6) uses Shared Socio-economic Pathway (SSP) scenarios.

to assess the state of the physical climate under a range of plausible futures. In this assessment SSP1-2.6 and SSP5-8.5 are used under the time horizons of 2030 and 2050. The choice of scenarios and time horizons used in this assessment is aligned to TCFD best practice.

The scenarios chosen for this assessment are:

- The SSP1-2.6 scenario, a low emissions scenario that remains below 2°C warming by 2100, aligned to current commitments under the Paris Agreement. Best estimate temperature by 2100: 1.8 °C.

- The SSP5-8.5 scenario, a high emissions scenario, which follows a ‘business as usual’ trajectory, assuming no additional climate policy, and seeing CO2 emissions triple by 2100. Best estimate temperature by 2100: 4.4 °C.

Two future time horizons are considered in the assessment together with the baseline (current climate) conditions. These were most applicable to JSC Navoiyazot’s business: 2030 (short-term, based on data from 2015-2044) and 2050 (long-term, based on data from 2035-2064).

Table 1: Key climate-related risks and opportunities identified for Navoiyazot

| Transitional risk & opportunities | Risk / Opportunity name | Risk description | Category | Risk /Opportunity |

| Carbon pricing regulations | It is expected that the transition to a low-carbon economy will require large scale implementation of carbon pricing mechanisms, which would affect a company’ s operational expenditure (OpEx). |

Policy & Legal | Risk | |

| Shift in financial stakeholder/ investor feedback | A tendency of investors favouring lower-emissions generators (sustainable investment) is expected. Chemical companies which prove that they are on track to achieve their climate targets or contribute with their products and services to a decrease in GHG emissions will be more attractive to investors while being a high-carbon emitting company potentially curbs interest of external investors. | Markets | Risk | |

| Enhanced emissions-reporting obligations | Currently, there are no emissions reporting obligations for Navoiyazot in Uzbekistan. Certain markets or regulations (e.g., the EU Carbon Border Adjustment Mechanism (CBAM)) will require carbon-related product declarations. Additional resources would be required for ESG management leading to increased operating expenses. | Policy & Legal | Risk | |

| Increased energy efficiency | Energy efficiency upgrades may result in potentially reduced OpEx through energy savings. | Resource Efficiency | Opportunity | |

| Opportunity to sell lower-carbon products | Customers in the European, American and/or Asian markets are increasingly favouring low carbon products as it helps them to achieve their own GHG goals and/or to be compliant with local or regional regulations. Navoiyazot is currently implementing / exploring decarbonisation of their production processes. | Products / Services | Opportunity | |

| Physical risks* | Extreme Heat | Heatwaves can result in need for increased capital expenditure (CapEx) for installing control systems like air conditioning. In addition, there is a possible impact on health and safety of site personnel. | Acute risk | Risk |

| Extreme Cold | Cold spells can lead to inefficiencies in temperature-sensitive production processes and increased costs for installing heating systems to maintain the necessary production temperatures. In addition, there is a possible impact on health and safety of site personnel. |

Acute risk | Risk | |

| Water Stress & Drought | Low water flows can reduce the quality and volume available for use, resulting in an increase in OpEx for the purchase of clean water for use in the production processes. Water infrastructure investments and improved water efficiency mechanisms may have to be implemented which will significantly impact CapEx. | Chronic risk | Risk | |

| Wildfires | Wildfires can cause direct damage to operational assets and health and safety of site personnel especially if there is direct flame and/or heat on infrastructure. This can have an impact on both CapEx and OpEx. | Acute risk | Risk |

*Other physical risks were also considered; however, their relevance was identified as low.

We are currently working to develop an action plan to address the climate-related risks and opportunities that were identified through scenario analysis.

There are some existing controls in place for physical risks:

- Hydrometeorological forecasts are conducted and considered at JSC Navoiyazot. In each new construction project, a normative document with maximum permissible parameters, such as wind speed, temperature thresholds etc. is considered;

- An analysis of emergency situations risks, including natural hazards, is conducted by the Department on Emergency Situations (in general, every three years). Based on this assessment a working group for addressing these risks may be established;

- An emergency preparedness group is established locally (which also considered natural hazards risks);

- Trees are planted around the plant to improve air quality and moderate air temperatures.

Transition risks and opportunities are addressed through the investment in the modernization of production / construction of environmentally friendly production facilities. A strategy covering new investment projects supporting GHG emission reduction and modernization of production facilities has been laid down. The company plans to implement a renewable energy project. In addition to the technical expertise, an overview of energy use, environmental expertise, and analysis of project compliance with regulatory requirements are conducted for each new project.

We are working on a more detailed action plan to respond to these climate-related risks and opportunities and will include it in future disclosures and in addressing climate-related risks in our strategic decisions.

3.RISK MANAGEMENT:

Our risk management system and processes are based on the Integrated Management System (IMS). There are established procedures for risk identification, risk evaluation, and development and control of actions to reduce risks in the framework of the IMS, signed by the Chairperson of the Management Board. We have prepared a risk register where we already partly cover physical and some transition climate-related risks, such as change in energy prices, risk of prices change for products, risk of unstable energy supply, and failure in the energy supply system, which are included in the risk register (currently not explicitly called 'climate risks’). Our risk identification includes a “top down” approach – risks identified at the top management level, and a “bottom up” approach – risks identified at the level of employees of structural departments and production. We have established communication between production level executives and the IMS risk management department: possible risks, including natural hazards and environmental risks are collected locally and are further summarized in a risk register.

With the completed scenario analysis for climate related risks and opportunities, we will expand our risk register with climate related topics.

4.METRICS & TARGETS:

Our holding company, UKS, has set ambitious climate targets that help transition the world towards the 1.5°-degree scenario: We at UKS are committed to reducing our Scope 1 and 2 GHG emissions by 42% by 2030 and working towards setting a short-term Scope 3 reduction target by 2025. Moreover, we are committed to reducing our absolute Scope 1-3 GHG emissions by 90% by 2050 with residual compensatory measures to achieve net zero. Our near- and long-term reduction targets are in alignment to limiting global warming to well below 2°C, thereby contributing to the Paris Agreement. For more information, please visit https://uzkimyosanoat.uz/en/esg/decarbonization.

These climate targets cascade down to the JSC Navoiyazot.

We assessed our baseline GHG emissions as 2,291kt/y of CO2eq (total Navoiyazot plant emissions in 2022).

We have already identified abatement technologies to reduce our Scope 1 and 2 GHG emissions for our Low Carbon Pathway. We are considering the implementation of renewable energy electrification, carbon capture and storage, N2O abatement, and green hydrogen to reduce our GHG emissions. We are currently evaluating these technologies for the potential implementation and developing an action plan.

In addition, we already launched first investment projects to make Navoiyazot’s production more sustainable. For more information, please visit https://www.navoiyazot.uz/en/menu/investitsionnaja-dejatelnost.

Regarding other non-GHG related metrics and targets, we track such metrics as maximum permissible concentration of air and water emissions, and conduct an overview of energy use, environmental expertise and analysis of project compliance with regulatory requirements, in addition to the technical expertise for each new project.